Can you make successful business deals with AI?

One of the challenges companies face when carrying out merger and acquisition transactions is gaining insight on a particular entity.

In addition to that, they have to deal with a lot of paperwork like signing contracts, which is time-consuming, considering human beings gather, process, and present critical data at a snail’s pace.

This is where AI comes in. Just like there’s a growth of value in M&A deals, technology is also coming up fast.

Actually, according to a survey by PWC, a quarter of the participant companies have observed a widespread adoption of AI compared to 18% in the previous year, while another 54% are heading there fast.

Machine learning and AI platforms provide real value for entities like investment firms looking to consolidate faster, by identifying potential risks that can derail the transaction process.

In this article, we’ll discuss how to leverage AI to turbocharge your mergers & acquisitions transactions.

Let’s get started.

1. Data Extraction

Companies produce a lot of data, be it from customers, previous contracts, or performance over the years.

However, most of this is unstructured data from social media comments and emails. Although reviewing this information can help you gain better insights on the market, analyzing the data can prove to be challenging, so it can easily go unused.

According to Deloitte, the global annual data creation by companies is expected to multiply by ten times. This will make it even more challenging to extract real-time value from this data by human beings.

With content intelligence tools, however, it is possible to review and analyze underutilized data from multiple markets within various countries for improved decision-making.

By leveraging AI-powered analytics tools, you can identify M&A targets, analyze their past account performance, and make future predictions of the entity.

In addition to that, by taking an algorithmic approach to analyze third-party target data, you speed up the execution process and increase your chances of experiencing a higher ROI, ultimately resulting in long-term gains.

A leading financial intelligence company provides a comprehensive database of information for M&A transactions. Since they collect unstructured data, the processing is time- intensive.

They sought Innodata as their solution which built a machine learning model and deployed natural language processing to rewrite headlines.

2. Due Diligence

Often, after the evaluation of third-party targets, an extensive due diligence follows. This is in regards to the business environment where the entity operates in, such as existing competition.

However, getting a transparent and complete view of the operational, cultural, and financial characteristics of an acquisition target is challenging.

This makes due diligence in most cases frustrating, painful, and risky to get deals done.

Content intelligence is particularly suitable for the due diligence process because it can review a lot of data and uncover potential red flags during commercial and reputational due diligence.

According to Okira, companies can reduce due diligence time by 30 to 90% when using AI for M&A.

Besides turbocharging your mergers and acquisitions transactions, adopting an AI model reduces the number of people needed in the due diligence process for complete transparency.

In addition to that, machine learning algorithms and AI-human analytics allow thorough vetting of target teams to analyze past unstructured data from sources like social media that can lead to potential compliance risks.

The Bank Advisory Group offers investment banking services, stock valuation, and principally M&A advice to community banks. Being involved in over 500 fair market valuations, it needed to streamline bank stock valuation. By using Firmex, they are able to perform pre-due diligence for data collection and due diligence.

3. Business Valuation

Upon identifying a target for your merger or acquisition, it is critical to value the business.

However, business valuation isn’t all that simple.

Financiers have to extract different multiples, such as earnings before interest, taxes, depreciation, and amortization (EBITDA) from the market then apply it to the financial performance of the target entity to determine its valuation.

This is a lengthy process that is often accompanied by errors due to the shifts in market trends.

One of the ways to leverage AI to turbocharge your mergers & acquisitions transactions is in business valuation.

Based on criteria such as company size and sector trends, AI can create valuation formulas for individual entities to determine how they would perform in particular environments.

According to CB Insights, larger companies command larger valuations than smaller ones due to greater income streams.

Content intelligence and machine learning tools can extract EBITDA and public share data in real-time, saving you time by deriving data-driven insights directly from a live database.

In fact, using the discounted cash flow (DCF) analysis, AI can gather information about the company’s discount factors and identify potential risks to its cash flows.

Fintech needed to provide their key client and other firms with a solution offering flexible deployment and custom workflows with sophisticated risk and pricing analytics. On seeking a valuation tool, FINCAD, Fintech was able to give its client a single platform to analyze diverse portfolios.

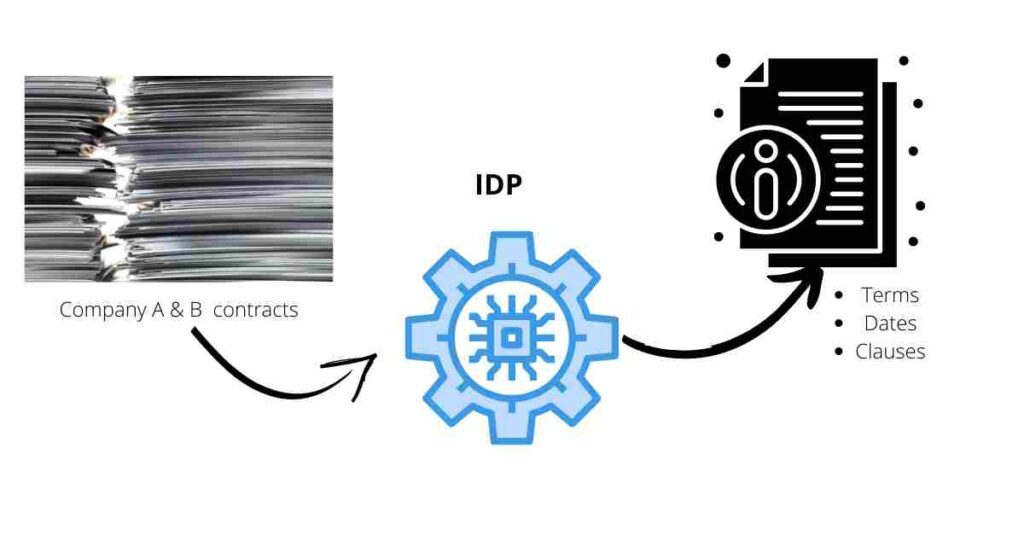

4. Negotiating/Contracting

Contracts provide a wealth of data in form of dates, timelines, prices, and returns, that provide essential insights in the lines of negotiations.

However, drafting merger and acquisitions contracts can be lengthy, especially when it comes to comparing contracts from both entities.

Identifying points of value loss or inefficiencies also proves challenging, resulting in risky errors.

Compared to a team of junior attorneys, content intelligence platforms can parse through thousands of contracts fast and accurately, and identify potential liabilities before a merger or acquisition.

In addition to that, AI is also aiding in contract drafting which saves on time, errors, and legal costs of M&A which are often as much as 30% of the total billing according to The Globe and Mail.

Through intelligent document processing, content intelligence platforms can extract unstructured data, such as dates, terms, and clauses from contracts and turn it into structured data. This, in turn, relieves the burden on legal resources needed to dissect clauses for better decision-making.

A Leading Big4 consulting firm had thousands of documents as part of a major M&A project and needed to automate contracts for review since the manual process would take long.

DocuSign integrated a platform with predefined analytics that was able to automate 90% of the review decisions.

5. Post-Merger Integration

Once two entities have merged or one has been acquired, the integration process is challenging and most times it is accompanied by errors and frustration.

This is because many processes are overlooked and manpower is highly depended upon to make the post-merger or acquisition a success.

In addition to that, various undocumented processes and institutional knowledge is lost during the staffing disruptions.

Some of the challenges experienced include:

- Synergy implementation

- Communication challenges

- Customer engagement

- Maintaining momentum

In fact, a PWC survey shows that only 13% of the executives reported favorable results in capturing revenue synergies.

AI-powered analytics tools are essential when it comes to identifying potential synergy risks, hurdles, and opportunities.

In addition to that, leveraging a content intelligence platform helps merger or acquisition entities maintain the momentum by transforming unstructured data into structured data and storing it in the cloud for future reference.

Instead of depending on undocumented processes and carrying out repetitive tasks like updating policies, AI and machine learning can take on those tasks to unburden employees.

Linda, the head of M&A finance and Integration at VMWare was experiencing challenges managing the ever-growing list of acquired companies with integration needs. By creating an M&A controller function, she was able to enable a better final-stage integration handoff.

Conclusion

Managing M&A transactions has many inefficiencies due to the lengthy and tedious process, unstructured data, and errors.

So when you have technologies such as AI and machine learning, you can speed up the entire process.

In fact, according to Nucleus research, junior law level associates save 50 to 80% of their time reviewing documents with AI.

Having gone through ways on how to leverage AI to turbocharge your mergers & acquisitions, such as data extraction and due diligence, I hope you can see how impactful it is to the success of your M&A endeavor.

If you’re already looking to merge with another company or acquire one, leverage a content intelligence platform to identify potential risks and enhance compliance.

![5 Innovative Applications of Artificial Intelligence in Manufacturing [2021]](https://geokongo.com/wp-content/uploads/2021/09/Applications-of-Artificial-Intelligence-in-Manufacturing-2021-1024x536.jpg)