Is your finance department a drag?

As the chief financial officer at your company, the weight of an entire finance department falls squarely on your shoulder.

From generating accurate variance reports and financial analysis to managing accounts receivable and payable, many iterative financial processes need oversight and eat up huge portions of your day.

That’s because these heavily rely on slow manual processing methods.

With RPA tools, financial departments can breathe easier as intelligent bots take up a lot of the donkey work by automating data extraction.

It, therefore, becomes easier to oversee and manage an accounting team.

In this article, we’ll be diving deeper into how all that is possible with 5 innovative use cases of RPA in finance and accounting in 2021.

Let’s get started.

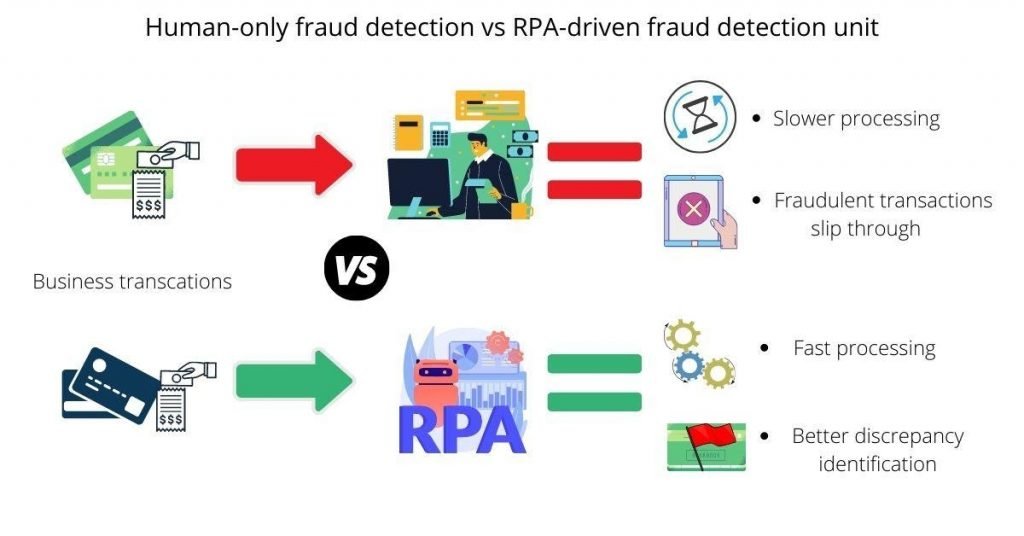

1. Fraud Detection Systems

How many transactions does your business handle daily?

Probably way too much to better keep an eye out on each one to identify financial discrepancies or anomalies.

However, with intelligent RPA building software like Peltarion you can reduce fraud vulnerabilities in your company by building an AI deep learning model.

The great part about Peltarion is that you don’t need to have programming skills because it is a no-code platform for all kinds of expertise.

Because of the sheer volume of financial transactions, it’s easy for employees to cook the books, or clients’ fraudulent activities to slip through the cracks.

Machine learning RPA software can establish suspicious patterns that often go unnoticed by financial officers.

The aforementioned deep learning model can establish normalcy parameters by observing regular account behavior and abiding by rule-based algorithms. When a certain rule is breached, the model raises an alarm.

In one of the most interesting uses of RPA in finance, TIAABANK is actively using RPA tools to tackle fraud.

The company’s fraud investigation unit can flag down suspicious activity on customer bank accounts, e.g. odd withdrawal amounts or patterns, via RPA monitoring.

After that, the team sets these aside for further action like credit card or account restrictions until customers can explain transaction anomalies in person.

2. Account Receivable Automation

As the Chief Financial Officer (CFO), you understand how your business’ cash flow crucially depends on proper Accounts Receivables (AR) management.

For one, a high Days Sales Outstanding (DSO) means company growth is shackled because funds are locked up in unpaid sales.

Delayed payments are often the case for most companies given that over 46% of invoices stretch past due dates, according to an Atradius survey.

RPA software can automate invoice processing for faster billing, in addition to also automating repetitive payment reminders.

Through electronic invoice generation after a purchase or service, your billing department doesn’t have to rely on manual data entry to process each bill.

Instead, intelligent document processing enables data extraction even from unstructured sources like physical paperwork. It then generates an electronic compilation that is made available across the organization via the cloud.

Further stretching the uses of RPA in accounting, the RPA software is able to send reminders, and even automatically update paid invoices through the power of deep learning algorithms.

If you’d like to learn more about how to create deep learning algorithms, you’ll love this article on how to learn machine learning in 7 simple steps.

Filled with incredible resources, this article will set you on your way to building your own RPA projects, or at least give you a better understanding of how it all comes together.

Banks such as KeyBank are already harnessing the power of RPA-fuelled AR management.

This US-based financial heavyweight was able to ease the burden of invoice processing on its officers, and also tackle late client payments as a result.

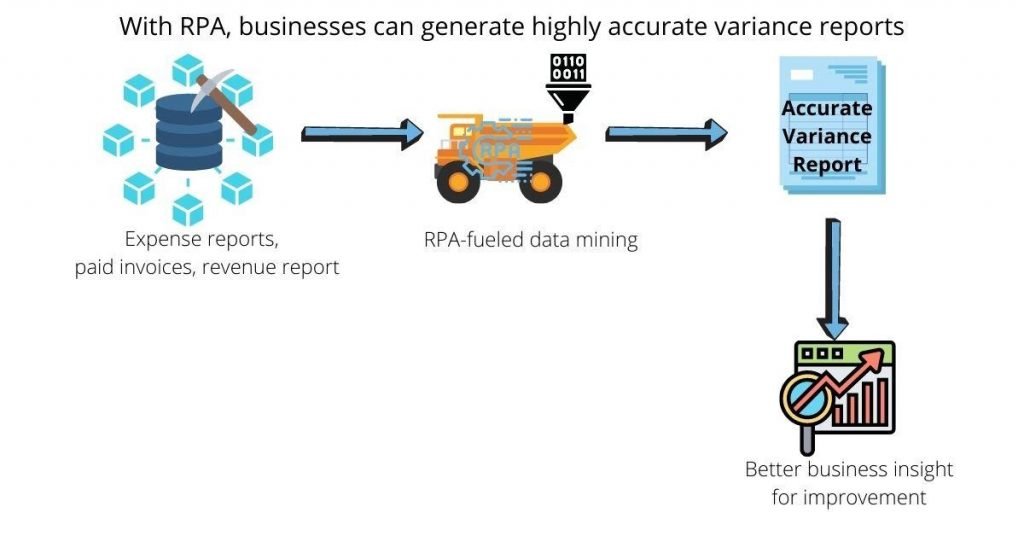

3. Financial Planning Systems

Does market research take up a lot of your time?

Staying on top of the latest financial trends or company performance is hard, never-ending work, yet it is crucial to enable workforce visibility and better plan for the future.

Additionally, human-generated variance reports, for example, aren’t always error-free or very reliable.

In one of the most innovative use cases of RPA in finance and accounting in 2021, RPA software is assisting in financial analysis and planning through data automation.

By automatic data extraction from various data inputs like stakeholder reports, RPA tools generate variance and performance reviews, among other financial reports, faster.

In addition to internal sources, RPA bots consider external data sources including real-time market dynamics, and a predictive system then provides market insight from this information.

It is for this reason that your finance department can keep up with countless financial statements and also stay on top of the latest capital expenditures.

As a real-life example of the uses of RPA in finance and planning, here’s how Peltarion can help your business predict purchase trends.

Using the power of tabular data and deep learning algorithms, you can establish a sales forecasting model that is highly dependable.

4. Customer Onboarding Processes

Is your customer onboarding process efficient?

Going by the findings of a Wyzowl 2020 survey, more than 90% of customers feel that there’s room for improvement with onboarding processes.

Customer education after onboarding came up as a major issue why most customers aren’t too happy with companies. RPA bots can help your business change all that in two ways.

First, RPA software can automate data entry through optical character recognition technology, and match client profiles with the necessary financial accounts and details.

Backed up by natural language processing, the software is able to fill the right data fields with matching information, therefore speeding up processing times.

Afterward, a compliance manager can provide the green light for the RPA software to complete the digitization of the new account, incorporating all the relevant financial details for the profile.

Secondly, you can create a simple no-code app to guide new clients to use your products, just like how Peltarion offers step-by-step tutorials to its new users.

Most customers jump ship because of not knowing how to use various products, but companies can now offer convenient RPA guides to hold customers’ hands after the sale.

5. Tax Compliance Checkers

Is your business tax compliant?

Human accounting errors like mistaking expenses for income, transposing numbers, and data duplication, just to name a few, can result in unintentional tax filing blunders.

Sometimes, these accounting faults can lead your company to overpay taxes, which means unexplainable gaps in your cash flow. Worse yet, tax underpayments lead to underpayment penalties, among other hefty enforcement consequences.

RPA software can eliminate violations resulting from manual data handling errors by turning physical tax forms into digital formats and automating tax processes.

For example, intelligent data extraction bots enabled by computer vision can populate blank fields with the relevant tax information from your company’s existing data sources.

Computer vision is a big aspect of RPA, and you can learn what else is by taking a look at this article on artificial intelligence trends to watch out for in 2021.

The article lays bare some crucial AI applications shocking the world this year, including a few interesting use cases that might benefit your own company.

Additionally, RPA technology can help with tax reconciliation.

Once your clerks have filled in tax documents, RPA software can crosscheck return taxes paid against those collected, as stated in the data fields, and a deviation can be accounted for accordingly.

Some fortune 1000 companies have already implemented RPA tax return filing.

As a result, these CFOs have been able to better achieve compliance and smoothen tax submission into the IRS system.

Conclusion

Can RPA improve your business’ accounting?

These innovative use cases of RPA in finance and accounting in 2021 provide overwhelming evidence that the answer is YES.

The finance department is the heart beat of your organization, yet it remains the fact that most accounting processes are not as efficient as they can be.

Many businesses are still reliant on error-prone manual data extraction resulting in tax violations and inaccurate financial reports, upon which huge revenue-driving decisions are made.

However, with RPA software automating data extraction and critical accounting chores, your financial processes run on clean data.

Implement RPA solutions to streamline your accounting processes today!

![5 Innovative Applications of Artificial Intelligence in Manufacturing [2021]](https://geokongo.com/wp-content/uploads/2021/09/Applications-of-Artificial-Intelligence-in-Manufacturing-2021-1024x536.jpg)