Does your business handle big data?

Many businesses today are feeling the impact of unstructured data, which is locked up in physical documents and old legacy systems, making it nigh impossible for M&A prospects to fully understand what they are getting into.

Hidden debts remain hidden and market trends aren’t fully considered.

As a result, countless mergers and acquisitions head for a divestiture, sometimes even before the ink is dry. And when they get to that point, the damage, often to the tune of millions of dollars, has already been done.

Intelligent document processing is the solution to these data obscurity problems. By breaking down data silos and availing important information, M&A partners can better make decisions.

In this article, we’ll be discussing why unstructured data is the enemy via lessons from M&A deals that bit the dust.

Let’s get started.

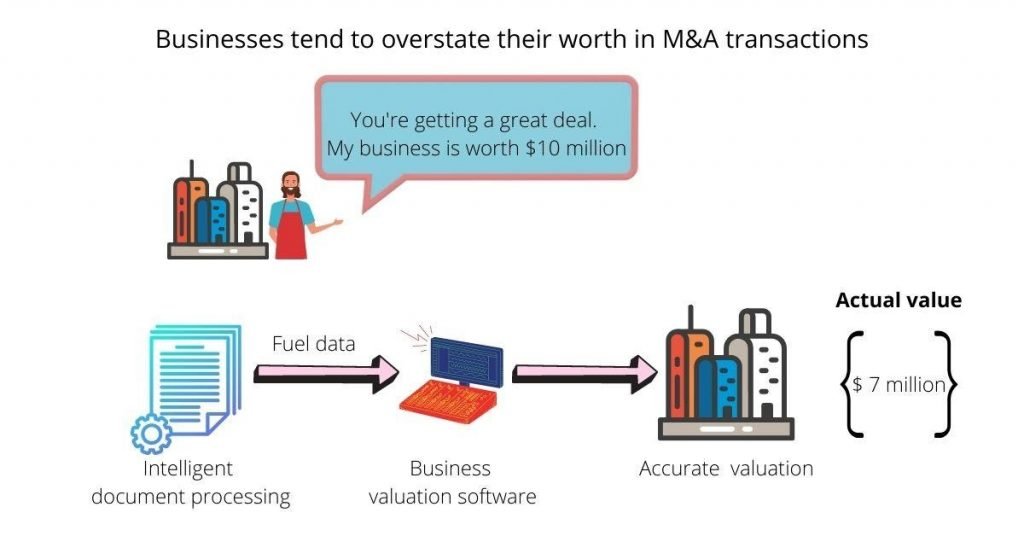

1. Inaccurate Business Valuation

Do you have a data governance strategy?

If you don’t, your business likely won’t get the best M&A deals.

If you do have a data governance strategy but aren’t quite sure if it’s effective, then you should take a look at this article that sheds light on important aspects of data governance.

Companies overpaying because of poor valuation techniques, resulting from an absence of sufficient data or a means of rummaging through data silos, is a huge reason why many M&A deals are short-lived.

Several companies have gone into business, only to later find out that they paid a little too much over the acquisition’s worth.

Case in point, Quaker Oats Co. who paid $1.7 billion to buy Snapple Beverage, in a deal that would end up costing the former more than $1.4 billion in losses, as they resold Snapple for a mere $300 million.

Why did that happen?

Because data silos hid crucial financial details that would knock off at least one zero from the buying price. Unstructured data in this case resulted in the company paying a staggering $1 billion above what they should have paid.

To break down these silos, your business needs intelligent document processing (IDP) tools with automated document conversion capabilities.

Using such a tool enables you to collect all company documents, digitize them and convert them into data suitable for analysis, storage, and archiving. So you get to transform unstructured data, enhance analytics, and improve efficiency while offering full insight across your organization’s various branches and departments.

As an example, ValuAdder offers a business valuation software powered by intelligent data. It enables companies to consider numerous data points, including business sale comparables, assets, and income, to create a valuation estimate.

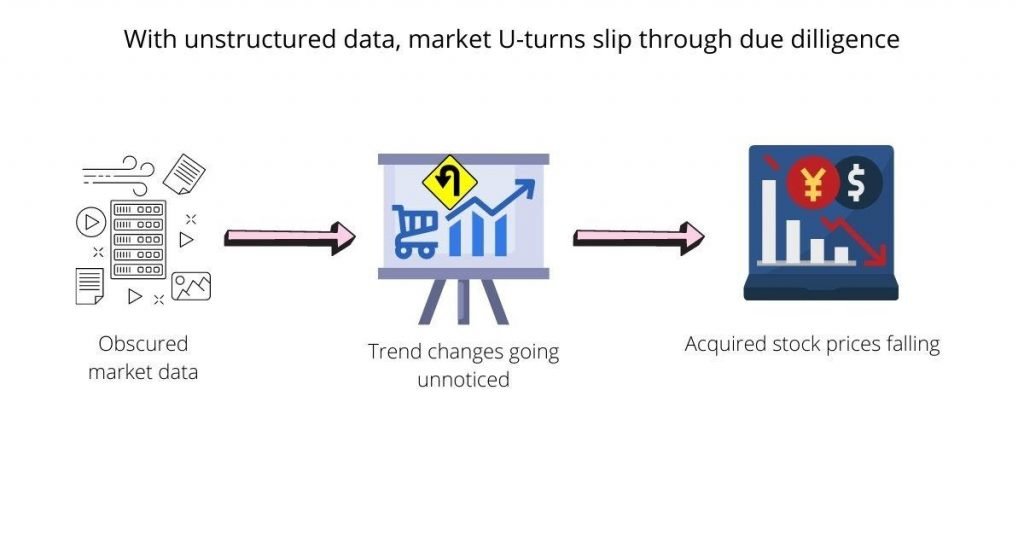

2. Unexpected Market U-turns

Many times, a deal looks good on paper.

It starts out that way at least, and all signs point to a successful M&A transaction. Then out of the blues, stock prices start dwindling because of a new trend in the market that no one saw coming.

While due diligence was carried out, this was restricted to only looking at the past rather than what lies ahead.

America Online was a victim of similar circumstances when it merged with Time Warner, in what has become one of the largest M&A flops in US history.

After the dot-com bubble burst, America Online’s value took a nosedive, reporting a net loss in the region of $99 billion.

All that could have been avoided with intelligent document processing, which, in combination with machine learning systems, is able to predict dissipating financial and social trends affecting the value of a potential acquisition.

By considering real-time market data to predict patterns, IDP and data science tools, via deep learning algorithms specifically, offer a hint of financial pitfalls some way up the road.

The key to M&A success, and general business growth, lies in knowing how to make sense of big data, and the article above offers tips to kickstart your digital enlightenment.

As a result, your business can have a better perception of not just the current market of the business you’re likely to merge with or acquire but also its long-term future.

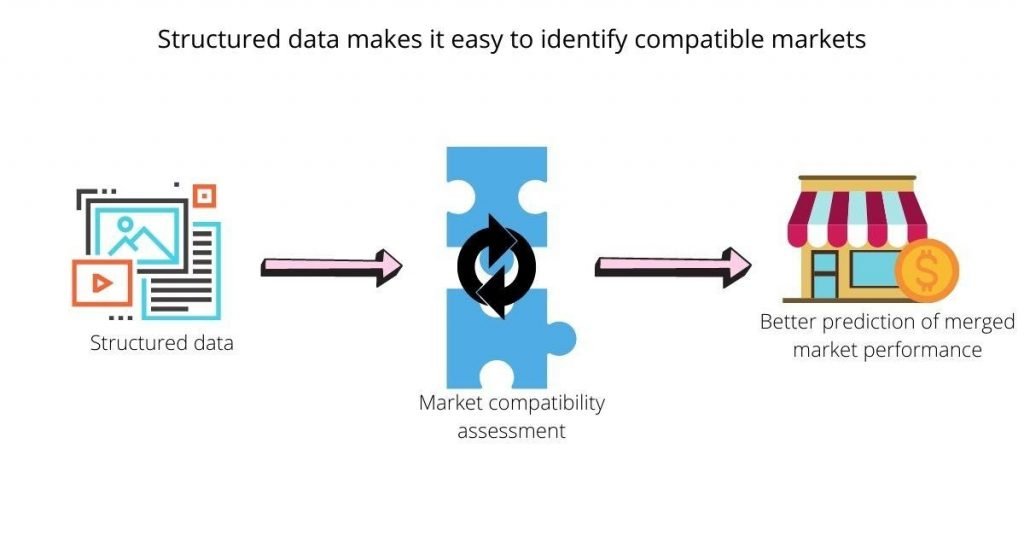

3. Target Company Incompatibility

Every business has its own niche.

Bridging these two separate niches also brings new market considerations to the table.

Another reason why unstructured data is the enemy of M&A success is the inability to fully understand if the customer bases of two separate companies are fully compatible, and the resulting resources available.

Occasionally, two different niches are better apart, as they can get in the way of each other.

This misunderstanding often stems from poor due diligence, which is typically contributed to by unstructured data sources in client paperwork and emails.

Intricate market details, tied up in isolated case studies, in one company remain invisible to the other. It, therefore, becomes challenging to judge the success probability of diverse target markets.

In 2003, grocery chain Morrison acquired Safeway, a huge rival at the time, in a bid to eliminate the competition and expand into Safeway’s already established networks.

It was a move that failed miserably.

Chairman Sir Ken Morrison attested to a lack of detailed due diligence as the major reason why profit margins had dropped after the acquisition.

Additionally, inventory records weren’t fully available, and the supermarket chain was unable to pick out overstocking situations.

Had the company made use of intelligent document processing technologies, Morrison would have not only spotted the inventory red flags but also gained important insider knowledge on the new markets.

As an example, Walmart is using IDP tools to establish market trends via the power of predictive analytics.

The eCommerce giant is able to stock appropriately and make other important market decisions because of the data it collects at point-of-sales terminals.

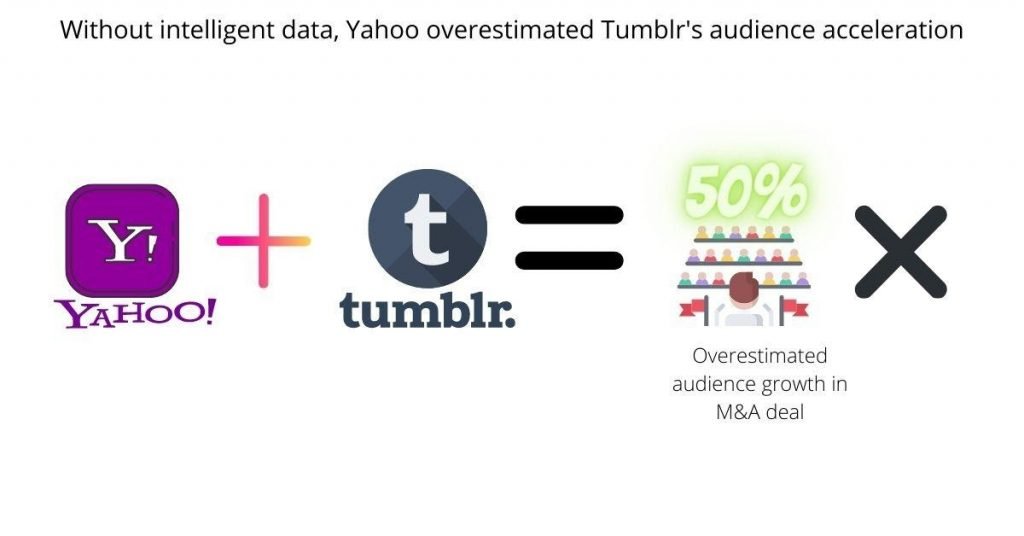

4. Unrealistic Sales Expectations

Most of the time, companies get into M&A transactions with unrealistic expectations of what either party is to gain from the deal.

Guided by scanty data and gut intuition, billion-dollar merger transactions are made with the promise of market expansion and soaring profits.

At the end of the day though, the narrative remains just that: a narrative.

In 2014, Yahoo fell into a similar predicament when it acquired Tumblr in a deal worth $1.1 billion.

A seemingly promising combination was soon headed for the exit door. This was significantly contributed to by the unrealistic sales expectations of Yahoo’s then-CEO Marissa Mayer.

An estimate of a 50% audience growth for Yahoo’s networks from the M&A was farfetched. To make up for Tumblr failing to turn a profit, the CEO set a highly ambitious sales target of $100 million, which proved to be the final nail in the coffin.

In a nutshell, Yahoo lost over $700 million and the acquisition failed because their sales projections were off the mark.

Using machine learning to leverage the data obtained through intelligent document extraction, Yahoo would have been able to view the true market potential of Tumblr.

Yahoo would have gotten a better estimate of market expansion, instead of making a snap judgment based on seemingly obvious potential.

To avoid following in the same footsteps you too can build a simple deep learning prediction model to anticipate sales gains.

It isn’t as hard as you imagine, and this article on how to learn machine learning will get you the knowledge push you need.

The article offers insider tips for building your own intelligent forecasting tools by leveraging some free but powerful open-source libraries.

5. Hidden Accounting Malpractices

Often, companies try to hide debt or malpractices to present a profitable company image to potential buyers.

While everything looks in order at face value, the devil is in the detail.

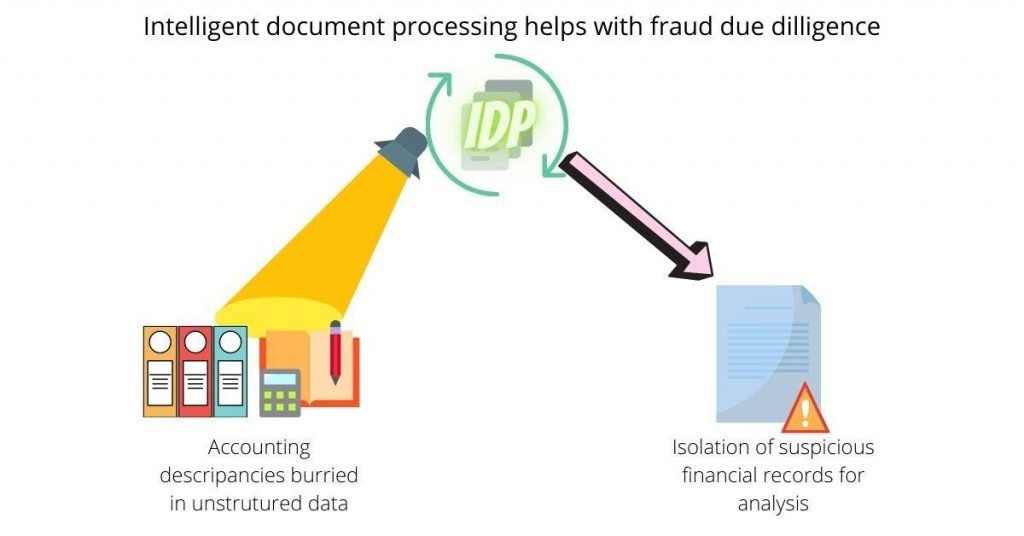

Buried deep within unstructured data, financial malpractices sneak right under the noses of analysts, only coming to light months after a deal is struck.

The result is employee downsizing leading to an eventual write-off, with the buying company incurring an immense loss.

Case in point, the Caterpillar and ERA merger.

In 2012, the Chinese coal market was one of the biggest in the world. Via a merger with ERA to acquire Siwei Ltd, Caterpillar looked to infiltrate that market, with easy money seemingly on the horizon.

However, Siwei Co Ltd hadn’t been totally honest about its accounting books. Something that the US-based heavy equipment manufacturer only found out after laying down 86% of the $677 million for the acquisition.

Accounting discrepancies were rampant, and because of due diligence oversight, they largely went unnoticed until it was too late.

Had Caterpillar put more effort into the research process, and obtained intelligent document processing tools to sift through the noise and identify key financial details, they wouldn’t have been counting their losses five months into the deal.

With IDP digitizing unstructured data and feeding it into an easily searchable cloud storage, analysts would have been able to easily find important accounting details.

Conclusion

So why is unstructured data the enemy?

These lessons from M&A failures provide ample reasons.

Unstructured data leads to a huge problem called dark data. That refers to information hidden within an organization’s independent information resources.

Dark data becomes especially risky during M&A transactions, as it inhibits companies from getting a full view of new markets while hiding financial dealbreakers.

It is for this reason that you might want to learn about building a big data pipeline, and ultimately embrace intelligent document processing and the benefits of a cloud-based data network.

Beyond providing valuable data for M&A due diligence, IDP systems also ensure better business productivity in many other ways.

![5 Innovative Applications of Artificial Intelligence in Manufacturing [2021]](https://geokongo.com/wp-content/uploads/2021/09/Applications-of-Artificial-Intelligence-in-Manufacturing-2021-1024x536.jpg)